An aging sales returns and allowances schedule provides clear insight into overdue accounts, enabling timely and strategic collections. Once invoices are grouped by age, the total amount outstanding in each category is calculated. This step provides a clear view of the overall receivables and the extent of overdue accounts. For example, if a significant portion of the accounts receivable falls into the 91+ days category, it indicates potential cash flow issues and may require urgent collection action. Creating an aging report is a fundamental task for managing accounts receivable effectively. It begins with gathering all outstanding invoices and organizing them by customer.

This can help you make essential capital-related decisions as you’re aware of what’s coming next. Businesses can prepare reports manually or use software that extracts information from the accounts receivable ledger. This time bucket reporting is readily available as a standard report in most accounting software packages. If you’re looking to improve your payment collection process, consider using Tabs’ AI-powered contract extraction tool to ensure accurate billing from the start. This can significantly reduce errors and disputes that often lead to overdue payments, ultimately improving your DSO and CEI.

- For example, most companies bill their customers toward the end of the month, and the aging report is generated days later.

- The likelihood of collection diminishes considerably, requiring a thorough review to determine the appropriate course of action.

- Regularly reviewing these reports helps SaaS businesses identify trends, prioritize efforts, and ultimately boost their bottom line.

Accounts receivable aging method

On the Balance Sheet, we can see that the desired balance of $4,905 is reflected in the new balance of the account. Read our updated 2025 review of the Capital on Tap Business Credit Card for UK businesses. Your Wise Business account comes with local account details to get paid in 8+ major foreign currencies like Euros and US Dollars just as easily as you do in Pounds.

If instead the allowance account had a debit balance of $3,000, bad debt expense would be $54,000 (i.e., $51,000 + $3,000). If you continue delivering goods or services to a customer who hasn’t paid for several months, that business may have a larger issue. Persistent outstanding A/R can signal that a company is experiencing significant financial difficulties or is at risk of failing.

Conceptual theory of accounts receivable aging

This information helps you make more informed decisions about extending credit and managing your overall risk. Some insurers also offer support with debt collection, providing expertise and resources to help recover outstanding payments. This can be suspense account in quickbooks especially helpful for smaller SaaS businesses without dedicated collections teams.

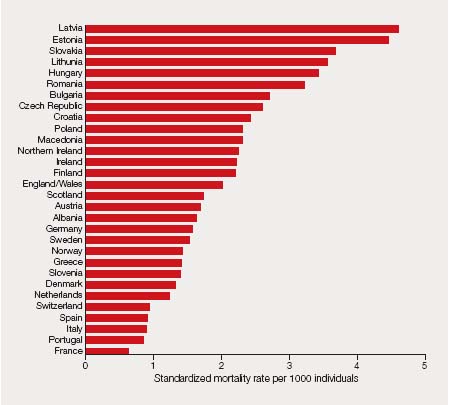

This method groups receivables into different time categories, often in 30-day increments like 0-30 days, days, days, and over 90 days. These categories help businesses assess their receivables and spot potential issues with late payments. On average, most invoices are paid within 30 to 45 days, though this can vary based on industry standards and customer relationships. An accounts receivable aging report allows businesses to track unpaid customer invoices and any unused credit notes.

Regularly reviewing these reports helps SaaS businesses identify trends, prioritize efforts, and ultimately boost their bottom line. For example, there are fewer receivables in the aging report created before the month-end, but there are more receivables payments for the company. The company’s management should match their credit terms with the periods of the aging report to get a clear picture of the accounts receivables.

Research by Upflow shows that over half of unpaid invoices (57%) are overdue, and a third (33%) take over 90 days to get paid1. An accounts receivable aging analysis is helpful in such scenarios as it allows businesses to be proactive and follow up on payments for prior bills. InvoiceSherpa is a particularly helpful tool for small and medium-sized businesses as it automates invoice tracking, aging categorization, and payment reminders.

To mitigate future risks, businesses should reassess their credit policies and consider stricter credit checks or shorter payment terms for high-risk customers. It enables companies to pay their bills on time, invest in growth opportunities, and maintain a healthy financial position. However, managing cash flow can be challenging, especially when dealing with outstanding receivables.

- InvoiceSherpa is a particularly helpful tool for small and medium-sized businesses as it automates invoice tracking, aging categorization, and payment reminders.

- Businesses can prepare reports manually or use software that extracts information from the accounts receivable ledger.

- To mitigate future risks, businesses should reassess their credit policies and consider stricter credit checks or shorter payment terms for high-risk customers.

- If the aging report shows a lot of older receivables, it means that the company’s collection practices are weak.

- In many cases, exam questions may directly provide the ending balance derived from the aging schedule, simplifying the calculation process.

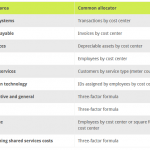

Assessing Credit Risk and Setting Allowance for Doubtful Accounts

The company can determine whether they should keep doing business with those who’re paying late. Providing flexible payment plan options can help customers facing financial difficulties stay on track and avoid falling significantly behind. Regularly auditing AR aging reports can help identify recurring issues, allowing for quick problem-solving. You can see that the estimated uncollectible percentage increases with the accounts receivable age. As noted, typically older accounts receivable have higher probabilities of being uncollectible. Such percentage are estimated by the company’s management based on past experience and judgment.

How an aging report works

The Current Expected Credit Losses (CECL) model, established by the Financial Accounting Standards Board (FASB), emphasizes forward-looking analysis. Companies must consider historical data, current conditions, and economic forecasts to estimate credit losses. Some customers tend to not pay their invoices when they are due, and they may wait until the second and third invoice reminders to settle their outstanding balance.

What is the Journal Entry for Aging of Accounts Receivable Method?

Monitoring receivables regularly can help you identify at-risk accounts, reduce bad debt, and maintain a healthy cash flow. By tracking aging receivables, you can take proactive steps to secure payments and optimize your business’s financial stability. The aging accounts receivable method helps in preparing a report that gives a detailed list of all invoices due and overdue for payment. It is a tool used in the collections department and for management decision-making to assess the credit policy and client creditworthiness. Beyond financial protection, trade credit insurance can provide valuable insights into customer creditworthiness. Some providers offer credit-checking services as part of their insurance packages.

Why is the aging of receivables formula important in cash flow management?

Empowering your team with the knowledge and resources they need ensures the aging report becomes a valuable tool for improving your company’s financial health. This proactive approach can transform your accounts receivable management, saving time and reducing errors. An accounts receivable aging report is used by the collections staff to identify which invoices are overdue. This becomes the basis for collection call activity, where the collections person can reference the report to identify the invoice number, invoice date, and amount unpaid. This is not an ideal use of the report, since the credit department should also review invoices that have already been paid in the recent past.

It provides a structured view of what’s owed to your business and helps you understand the overall health of your accounts receivable. For example, consider a business that produces high-quality laser tag harnesses, exclusively selling to professional teams on the Tag, You’re It circuit. In the past few months, the company has fulfilled orders for Alpha Co., Bravo Co., and Charlie Co. — three prominent teams in the league. As part of your accounts receivable management efforts, you routinely create aging reports at the end of each month. Understanding this method is essential for effective financial management and reporting. Thus the above details clearly states the aging accounts receivable excel template.

Even with the best software, your team needs training to use the aging of receivables report effectively. Ensure they understand how to interpret the report, identify at-risk accounts, and follow established procedures for collections. Training should cover the software’s features and the importance of accurate data entry. Clear guidelines on escalating overdue accounts and communicating with customers how to write an analysis essay are also crucial. Modern billing software often includes automated report generation, customizable aging intervals, and direct integration with your accounting system.